Fixed rate mortgages have a set interest rate so that the monthly principal and interest payment stays the same for the life of the loan. We offer Fixed Rate Conforming Loans at both 15 and 30 year terms. Adjustable Rate Mortgages (ARM) An ARM will typically feature a fixed interest rate for an introductory period. Source: Freedomz, Shutterstock Established in 1847 in New Zealand, as Auckland Savings Bank, commonly known as ASB, is a subsidiary of Commonwealth Bank of Australia (ASX:CBA). ASB is a provider of financial services like funds management, retail, b.

Asb Pie Term Deposit Rates

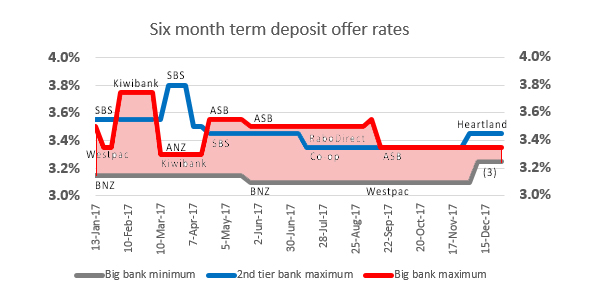

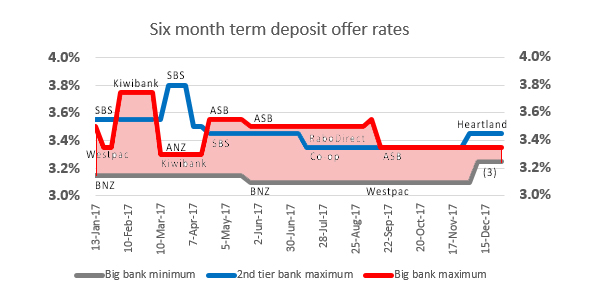

With this interest rates table, you can use the arrows to sort by various options such as interest rate, provider, amount and rating.

Rates changes from the past seven days will be highlighted in green or red.

NEW: Click on a provider's name or logo to see all their rates.

Asb Mobile Deposit

| All | Term Deposits | Call Accounts | Online Call Accounts | Savings | Debentures | Bonds | By Provider |

Provider

| Product

| Minimum Deposit

| Maximum Deposit

| 30 days

| 60 days

| 90 days

| 5 months

| 6 months

| 9 months

| 12 months

|

|---|

| ANZ | Term Deposits | $10,000 | - | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

| Term Investment | $5,000 | $9,999 | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80▲ | 0.80▲ |

| Term Investment | $10,000 | $49,999 | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80▲ | 0.80▲ |

| Asset Finance | Term Deposit | $2,500 | - | - | - | - | - | - | 2.50 | 3.30 |

| BNZ | Term Investment | $2,000 | $5,000,000 | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

| China Construction Bank | Term Deposit | $100,000 | $5,000,000 | - | - | - | - | - | - | - |

| Co-operative Bank | Term Deposit | $2,000 | - | 0.15 | - | 0.40 | - | 0.95 | 0.95 | 0.95 |

| Co-operative Bank | Special Term Deposit | $5,000 | - | - | - | - | - | 1.00 | - | 1.00 |

| Term Deposit | $1,000 | - | - | - | - | - | 1.30 | - | 2.30 |

| First Credit Union | Term Investment | $500 | - | - | - | 0.75 | - | 1.10 | 1.15 | 1.20 |

| General Finance | Deposit Rate | $5,000 | $100,000 | - | - | - | - | 2.55 | 3.10 | 3.55 |

| Heartland Bank | Heartland Term Deposit | $1,000 | - | 0.15 | 0.25 | 0.40 | - | 0.90 | 0.90 | 1.00 |

| Heretaunga Building Society | Term Investment | $1 | - | - | - | 0.40▼ | - | 0.80▼ | - | 1.00 |

| HSBC Premier | Term Deposits | - | $9,999 | 0.05 | - | 0.05 | 0.10 | 0.10 | 0.10 | 0.10 |

| HSBC Premier | Term Deposit | $10,000 | $99,999 | 0.07 | - | 0.10 | 0.35 | 0.60 | 0.60 | 0.60 |

| HSBC Premier | Term Deposit | $100,000 | - | 0.10 | - | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

| Kiwibank | Term Deposits | $1,000 | $4,999 | - | - | 0.25 | 0.25 | 0.50 | 0.50 | 0.50 |

| Kiwibank | Term Deposits | $5,000 | $9,999 | 0.05 | 0.15 | 0.25 | 0.50 | 0.80 | 0.70 | 0.90 |

| Kiwibank | Term Deposits | $10,000 | - | 0.15 | 0.25 | 0.35 | 0.60 | 0.90 | 0.80 | 1.00 |

| Kookmin - NZ | Term Deposit | $10,000 | $49,999 | 0.10 | 0.10 | 0.30 | 0.40 | 0.60 | 0.60 | 0.90 |

Provider

| Product

| Minimum Deposit

| Maximum Deposit

| 30 days

| 60 days

| 90 days

| 5 months

| 6 months

| 9 months

| 12 months

|

|---|

| Kookmin - NZ | Term Deposit | $50,000 | $99,999 | 0.10 | 0.10 | 0.30 | 0.50 | 0.70 | 0.70 | 1.00 |

| Kookmin - NZ | Term Deposit | $100,000 | - | 0.10 | 0.10 | 0.40 | 0.60 | 0.80 | 0.80 | 1.10 |

| Kookmin - NZ | Term Deposit | $5,000 | $9,999 | 0.10 | 0.10 | 0.30 | 0.30 | 0.50 | 0.50 | 0.80 |

| Term Deposit | $5,000 | $19,999 | - | - | 2.45 | - | 2.90 | 2.95 | 3.00 |

| Term Deposit | $20,000 | $99,999 | - | - | 2.50 | - | 2.95 | 3.00 | 3.05 |

| Term Deposit | $100,000 | - | - | - | 2.55 | - | 3.05 | 3.10 | 3.15 |

| Napier Building Society | Term Deposit | $5,000 | - | - | - | - | - | - | - | - |

| Nelson Building Society | Term Deposit | $5,000 | $250,000 | 0.15 | - | 0.45 | - | 0.85 | 0.85 | 0.95 |

| NZCU Auckland | Investment Account | $500 | $9,999 | - | - | 0.60 | - | 1.05 | 1.05 | 1.10 |

| NZCU Auckland | Investment Account | $10,000 | $500,000 | - | - | 0.60 | - | 1.10 | 1.10 | 1.15 |

| NZCU Baywide | Term investment | $1,000 | $1,000,000 | 0.15 | 0.15 | 0.50 | 0.70 | 0.90 | 0.95 | 1.00 |

| NZCU South | Term investment | $1,000 | $500,000 | 0.15 | 0.15 | 0.50 | 0.70 | 0.90 | 0.95 | 1.00 |

| Public Trust | Term Deposit | $5,000 | $9,999 | - | - | 1.00 | - | 1.00 | 1.00 | 1.00 |

| Public Trust | Term Deposit | $10,000 | $49,999 | - | - | 1.00 | - | 1.00 | 1.00 | 1.00 |

| Public Trust | Term Deposit | $50,000 | $249,999 | - | - | 1.00 | - | 1.00 | 1.00 | 1.00 |

| Public Trust | Term Deposit | $250,000 | - | - | - | 1.00 | - | 1.00 | 1.00 | 1.00 |

| Rabobank Term Deposits | $1,000 | - | 0.20 | - | 0.25 | - | 1.00 | 1.00 | 1.00 |

| SBS Bank | Term Investment Specials | $1,000 | $250,000 | - | - | 0.40 | 0.50 | 0.90 | 0.90 | 1.00 |

| Term Deposit | $5,000 | $9,999 | 0.05 | 0.10 | 0.25 | 0.45 | 0.70 | 0.70 | 0.70 |

| Term Deposit | $10,000 | $250,000 | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

Provider

| Product

| Minimum Deposit

| Maximum Deposit

| 30 days

| 60 days

| 90 days

| 5 months

| 6 months

| 9 months

| 12 months

|

|---|

| Wairarapa Bldg Socy | Term Investment | $500 | $1,999 | - | - | 0.45 | - | 0.45 | 0.45 | 0.45 |

| Wairarapa Bldg Socy | Term Investment | $2,000 | $4,999 | - | - | 0.45 | - | 0.65 | 0.70 | 0.75 |

| Wairarapa Bldg Socy | Term Investment | $5,000 | - | - | - | 0.50 | - | 0.95 | 1.00 | 1.05 |

| Term Investment | $5,000 | $5,000,000 | 0.15 | 0.20 | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

About Us | Advertise | Contact Us | Terms & Conditions | RSS Feeds |

Asb Time Deposit Rates

| Rabobank | 0.75 | | Based on a $50,000 deposit More Rates » |

| Co-operative Bank | 0.40 | | Heartland Bank | 0.40 | | SBS Bank | 0.40 | | Based on a $50,000 deposit More Rates » |

| Co-operative Bank | 1.00 | | Heartland Bank | 1.00 | | Kiwibank | 1.00 | | Kookmin - NZ | 1.00 | | Rabobank | 1.00 | | SBS Bank | 1.00 | | Based on a $50,000 deposit More Rates » |

| Co-operative Bank | 3.00 | | Based on a $50,000 deposit More Rates » |

| Institution | Rate | Product |

|---|

| First Credit Union | 2.00 | Online Savings | | NZCU Auckland | 1.00 | Success Saver | | Rabobank | 0.75 | Rabobank PremiumSaver - max rate | | NZCU Baywide | 0.60 | Success Saver | | Heartland Bank | 0.50 | Heartland Direct Call | | Based on a $50,000 deposit More Rates » |

| Institution | Rate | Product |

|---|

| Liberty Financial Limited | 2.50 | Term Deposit | | Public Trust | 1.00 | Term Deposit | | First Credit Union | 0.75 | Term Investment | | NZCU Auckland | 0.60 | Investment Account | | NZCU Baywide | 0.50 | Term investment | | Based on a $50,000 deposit More Rates » |

| Institution | Rate | Product |

|---|

| Gold Band Finance | 3.80 | Secured First Ranking Debenture Stock | | Asset Finance | 3.60 | Secured First Ranking Debenture | | General Finance | 3.55 | Deposit Rate | | Asset Finance | 3.30 | Term Deposit | | Liberty Financial Limited | 3.05 | Term Deposit | | Based on a $50,000 deposit More Rates » |

| Institution | Rate | Product |

|---|

| Asset Finance | 5.50 | Secured First Ranking Debenture | | Gold Band Finance | 4.90 | Secured First Ranking Debenture Stock | | Asset Finance | 4.25 | Term Deposit | | General Finance | 4.15 | Deposit Rate | | Finance Direct Ltd | 4.10 | Term Deposit | | Based on a $50,000 deposit More Rates » |

Weekly Updates including news and commentary Special Offers| Institution | Rate | Term | More | Minimum | Action |

|---|

Please note: Institutions pay to have their interest rates listed on this page. These offers are usually for a limited time. Please check with the institution direct to confirm details. | | Institution | Rate | 30% | 33% |

|---|

| ANZ | 0.10 | 0.10 | 0.11 | | ASB Bank | 0.05 | 0.41 | 0.42 | | ASB Bank | 0.05 | 0.59 | 0.56 | | ASB Bank | 0.05 | 0.61 | 0.64 | | ASB Bank | 0.08 | 0.66 | 0.69 | | ASB Bank | 0.08 | 0.72 | 0.75 | | BNZ | 0.10 | 0.10 | 0.10 | | Heartland Bank | 0.40 | 0.40 | 0.40 | | Kiwibank | 0.05 | - | - | | Kiwibank | 0.25 | - | - | | Nelson Building Society | - | - | - | | SBS Bank | - | - | - | | TSB Bank | 0.25 | 0.25 | 0.26 | | Westpac | 0.35 | 0.36 | 0.38 | | Westpac | 0.05 | 0.05 | 0.05 | | Westpac | 0.35 | 0.36 | 0.38 |

Coming Soon

MORE » |

Disclaimer - Every possible effort has been made to keep the information in the tables and on this site as accurate as possible, however, neither the publisher, Tarawera Publishing, nor anyone engaged to compile the rates and this site accept any liability for inaccuracies or any loss suffered as a result. It is strongly advised that readers check loan details with providers. The full terms and conditions of this site can be found here.

© Copyright 1997-2021. Tarawera Publishing Ltd. All Rights Reserved.